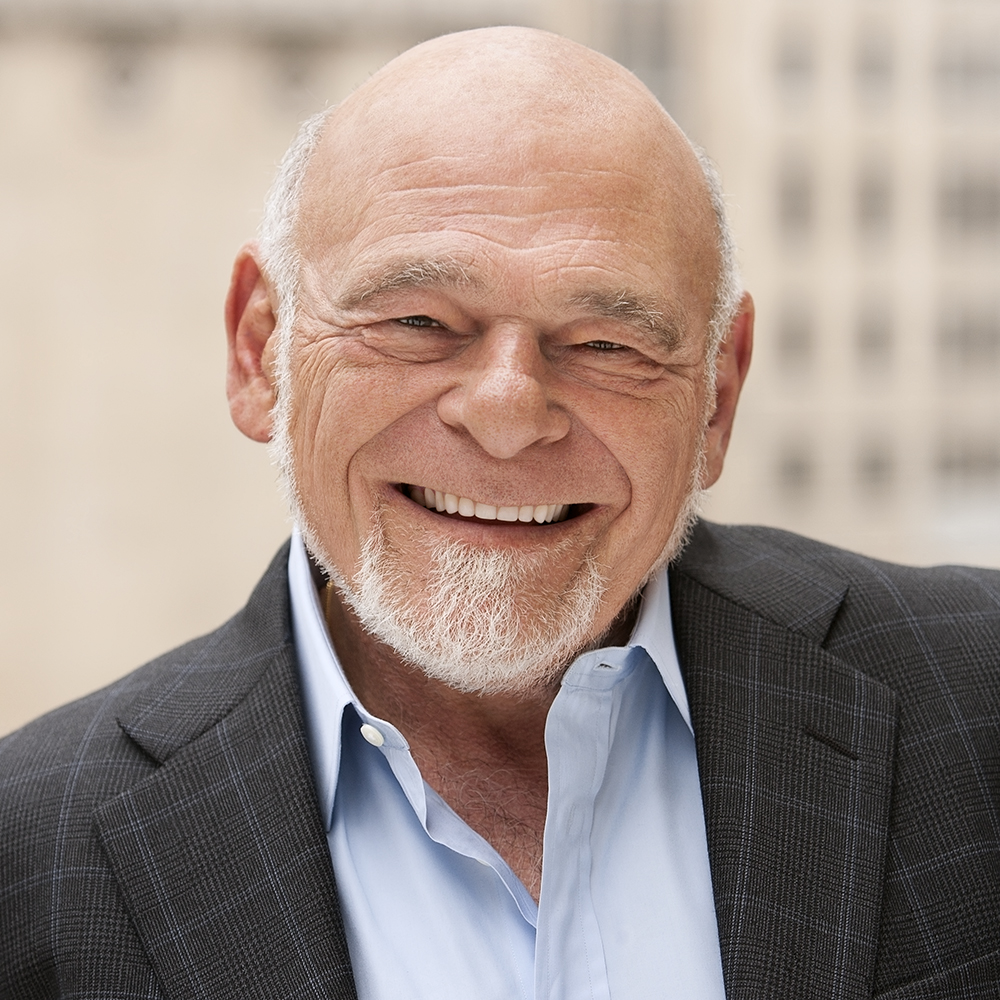

Sam Zell is a prominent American entrepreneur, investor, and real estate magnate. He was born on September 27, 1941, in Chicago, Illinois, United States. Zell is best known for his expertise in real estate investment and his ability to identify undervalued opportunities.

Zell started his entrepreneurial journey at a young age. While still in college, he began investing in real estate and quickly established a reputation for his shrewd investment decisions. In 1968, he founded Equity Group Investments (EGI), a private investment firm based in Chicago, which became the platform for many of his successful ventures.

Throughout his career, Zell made several groundbreaking deals and investments. One of his notable achievements came in the 1990s when he initiated the consolidation of the real estate industry. He created the real estate investment trust (REIT) model and founded the Equity Office Properties Trust (EOP), which eventually became one of the largest commercial office real estate companies in the United States.

In 2007, Zell made headlines with his purchase of the Tribune Company, a media conglomerate that owned prominent newspapers such as the Chicago Tribune and the Los Angeles Times. However, due to financial challenges and the changing landscape of the newspaper industry, the Tribune Company filed for bankruptcy in 2008.

Despite the setbacks, Zell remained an active investor and continued to make significant investments across various industries. He has been involved in diverse sectors such as energy, transportation, logistics, and manufacturing, among others. Zell’s investment philosophy is often characterized by his contrarian approach, seeking opportunities in distressed assets or industries undergoing significant changes.

Beyond his real estate and investment activities, Zell has been known for his candid and outspoken personality. He is often sought after for his insights on business and economic matters and has shared his perspectives through interviews and public appearances.

Sam Zell’s success in the business world has earned him numerous accolades and recognition. He has been listed on Forbes’ list of billionaires and has received various awards for his contributions to the real estate industry.

Sam Zell’s life and career exemplify the spirit of entrepreneurship, strategic investment, and the ability to navigate complex business landscapes. His legacy as a real estate magnate and investor continues to inspire many in the world of business and finance.

Certainly! Here are some more details about Sam Zell’s life and career:

Early Life and Education: Sam Zell was born to a Jewish family in Chicago. His parents were Rochelle and Berek Zell, who were Polish immigrants. Zell grew up in the suburbs of Chicago and attended the University of Michigan, where he earned a Bachelor of Arts degree with honors in 1963. He later went on to earn a J.D. degree from the University of Michigan Law School in 1966.

Equity Group Investments (EGI): In 1968, at the age of 27, Zell founded Equity Group Investments (EGI). The firm initially focused on investing in real estate, but over time it expanded into other industries. EGI’s investment strategies encompassed distressed debt, private equity, energy, and infrastructure, among others. Zell served as the chairman of EGI, overseeing its investment activities.

Real Estate Ventures: Zell’s expertise in real estate investment played a pivotal role in his success. In addition to founding Equity Office Properties Trust (EOP), which became the largest office real estate investment trust (REIT) in the United States, he has been involved in numerous significant real estate transactions. Zell has acquired and sold properties across various sectors, including commercial, residential, and industrial real estate.

Contrarian Investment Approach: Zell is known for his contrarian investment philosophy, often seeking out opportunities in distressed or undervalued assets. He believes in identifying investments that others may overlook or undervalue and capitalizing on their potential for growth. This approach has earned him the nickname “The Grave Dancer.”

Business Acumen and Deal-Making: Throughout his career, Zell has been recognized for his exceptional business acumen and deal-making skills. He has been involved in several notable transactions, including the sale of Equity Office Properties Trust to The Blackstone Group in 2007, which marked one of the largest leveraged buyouts in history at the time.

Tribune Company and Media Ventures: In 2007, Zell made a significant foray into the media industry with his purchase of the Tribune Company, a media conglomerate that owned newspapers, television stations, and other media assets. However, the Tribune Company faced financial difficulties, and it eventually filed for bankruptcy in 2008. Zell’s involvement with the company ended with the restructuring process.

Philanthropy and Civic Engagement: Zell has been actively involved in philanthropic endeavors. He has made substantial contributions to educational institutions, cultural organizations, and community development initiatives. Zell and his wife, Helen, have been committed supporters of various charitable causes, including education, healthcare, and the arts.

Awards and Recognitions: Sam Zell’s accomplishments have earned him numerous awards and recognition. He has been featured on Forbes’ list of billionaires and has received accolades such as the Cornell Icon of the Industry Award, the Real Estate Roundtable’s Lifetime Achievement Award, and the Fred A. Krehbiel II Medal for Outstanding Achievement in Business.

Sam Zell’s career trajectory and investment strategies have made him a prominent figure in the business and real estate sectors. His contrarian approach, entrepreneurial spirit, and bold deal-making have established him as one of the most successful and influential investors of his time.

This article is very good